The housing crisis in the UK continues to be a pressing issue, with many struggling to afford homes. A report, published in 2023, titled “Why have the volume housebuilders been so profitable?“, by UK Collaborative Centre for Housing Evidence, sheds light on the practices of the three largest housebuilders – Taylor Wimpey, Barratt Developments, and Persimmon – highlighting how their profit-driven strategies have exacerbated the housing shortage and increased the cost of buying a home.

Key Findings:

- Focus on Profit Over Volume:

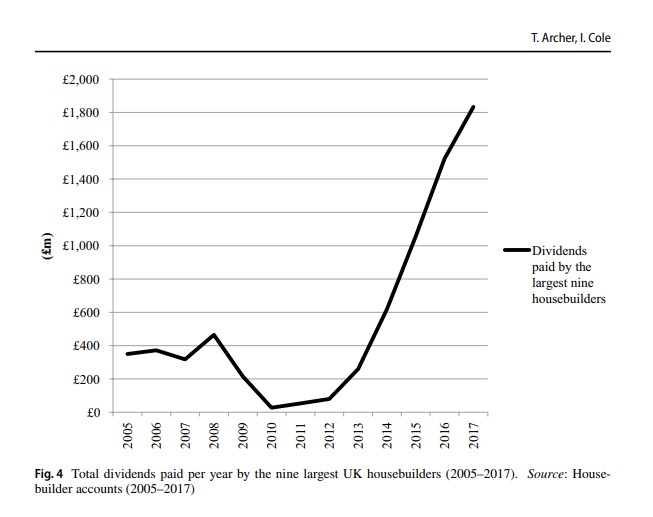

Since the Global Financial Crisis (GFC), the big three housebuilders have shifted their strategy from increasing the number of homes built to maximising profit margins. This focus on profitability has led to gross profit margins between 17% and 32%, far above the industry norm. However, this has come at the expense of building more homes, contributing to the persistent housing shortage. - Market Control and Supply Limitation:

These housebuilders have significant control over the housing market, often strategically limiting the supply of new homes to keep prices high. By doing so, they ensure continued demand for their developments, allowing them to sell homes at higher prices and maintain their profitability. - Government Support and Policy:

The state has inadvertently reinforced this profit-driven approach through policies and support schemes such as Help to Buy, which have increased demand without ensuring a corresponding increase in supply. This has allowed housebuilders to capitalise on government incentives, driving up house prices further and putting homeownership out of reach for many. - Impact on Housing Affordability:

The combination of limited housing supply and increased prices has made it increasingly difficult for first-time buyers and low-income families to enter the housing market. The report highlights that the big three’s approach has significantly contributed to the affordability crisis, with average house prices continuing to rise faster than wages. - Policy Recommendations:

To address these issues, the report suggests that policymakers need to re-evaluate the relationship with volume housebuilders and implement measures that ensure increased housing supply. This includes stricter regulations to prevent land banking, incentivising the construction of affordable housing, allowing local councils to build homes, and reducing the influence of large housebuilders on planning policies.

The profit-driven approach of the UK’s largest housebuilders has had a detrimental impact on the housing market. By prioritising high profit margins over the volume of homes built, these companies have exacerbated the housing shortage and driven up the cost of buying a home. Addressing this issue requires a concerted effort from policymakers to implement regulations and incentives that promote a more balanced and fair housing market.

So, the next time you hear someone blaming the housing crisis on immigration or the planning system, share a link to this article with them. The truth is that property developers are the ones who benefit the most from the shortage of housing in the UK, as they control both demand and supply to maintain their profitability.

Reducing the cost of building houses: A vital step towards solving the housing crisis

First dropped: | Last modified: June 11, 2024